1. High volume in direction of Trend

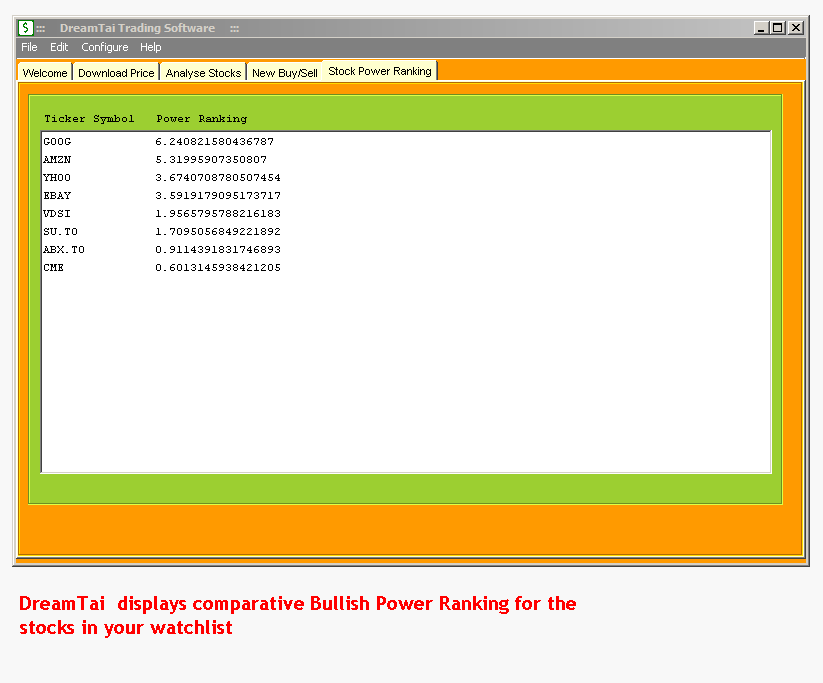

( as shown by the Power Ranking)

If you have 100 or 200 bullish stocks, use power ranking to find which has

more power (buying volume) than others and use this criteria to select

stocks for investing.

We use the volume in the Power

Rankings. No one can argue with volume. If an investor feels like shorting

a stock or some stock analyst is downgrading a stock but at the same time,

some hedge fund is secretly buying MILLIONS of stock, the volume will tell

the truth and the stock will increase in Power Ranking.

2. Existing Stock Trend

If the price bar is above the dotted moving average, it is bullish trend. If below the dotted average line, the trend is bearish

3. Momentum

This is shown by the color of the price bar. If the bar is green, the momentum

is bullish, if red, the momentum is bearish

4. Money Management and Risk control.

DreamTai automatically calculates the amount to invest so that your maximum

risk is 2 percent of your equity

Thus, we have four factors working in our favour.

1. High volume

2. Trend

3. Momentum

4. Money Management and Risk control.

This places the odds squarely in our favour. Of course, there will be some

losers along the way and that is part of the game because we have risk management

included in our strategy.

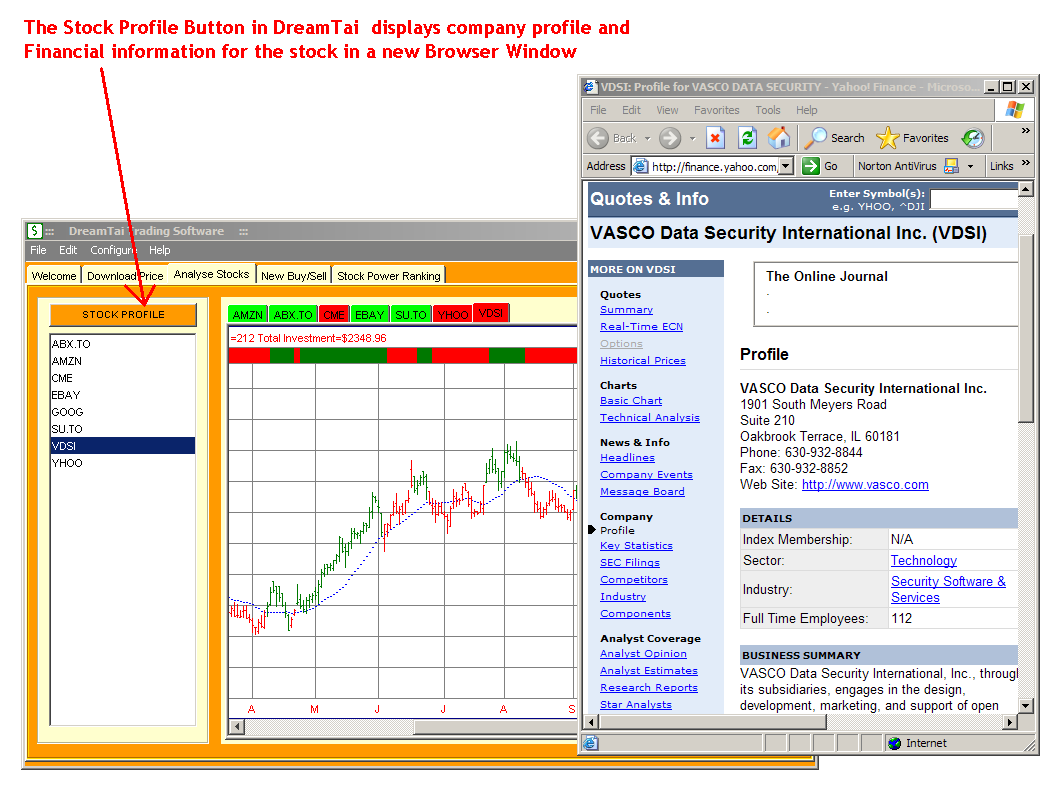

DreamTai uses a moving average of price to get the main price trend of the stock.

Also, if you have ten stocks in your portfolio, you need to know which stocks are strong and which stocks are weak.

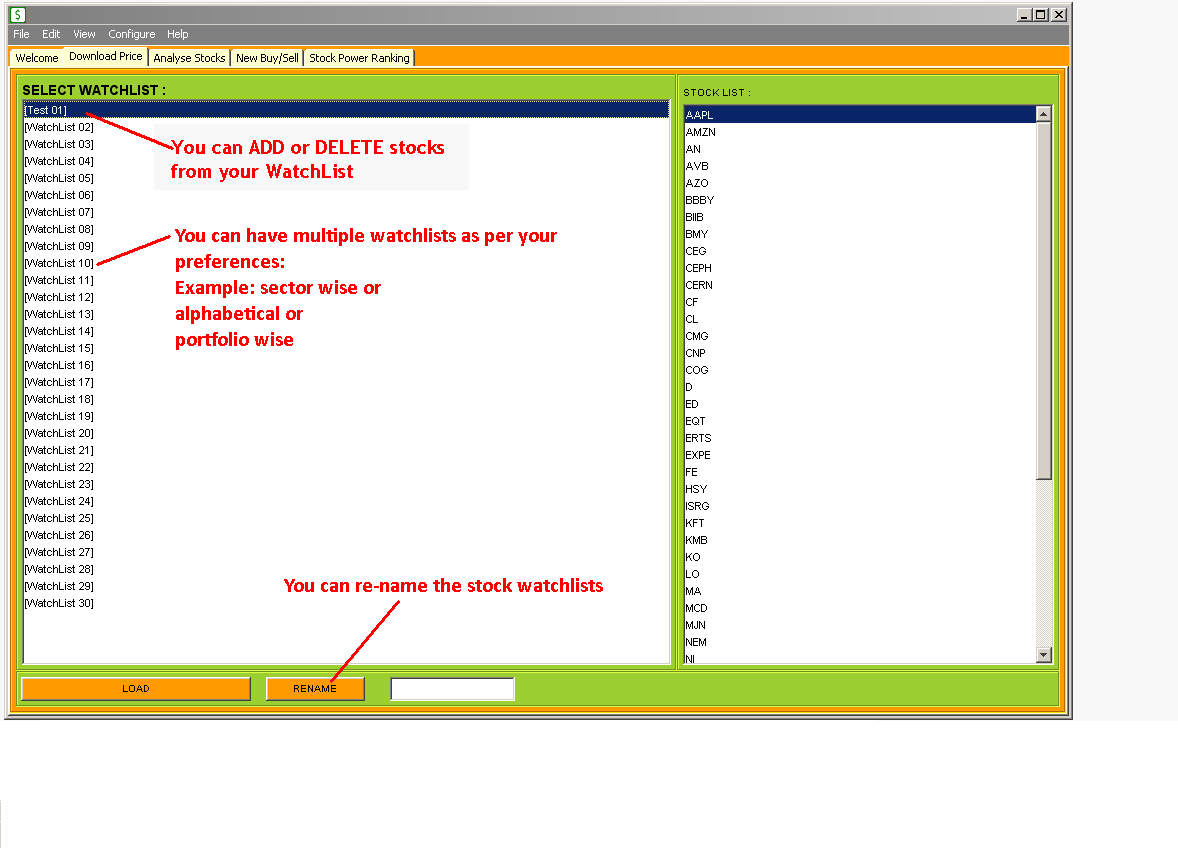

DreamTai Power Ranking feature does an inter stock comparision so you can filter out and remove the losers from your portfolio and decide which stocks to buy.

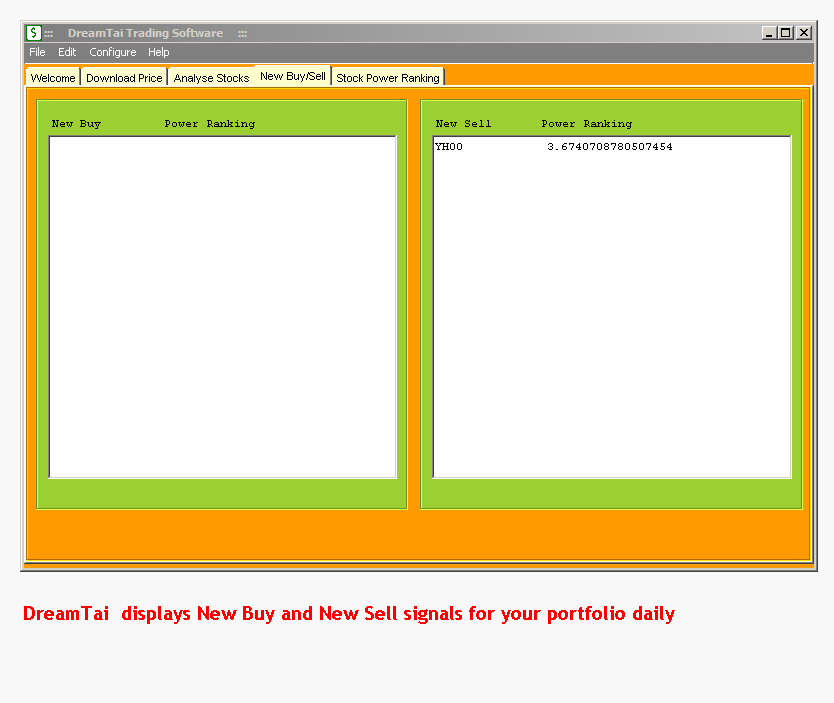

One of the most useful feature of DreamTai is the money management feature.

DreamTai helps you to control your risk by specifying exactly how many shares to buy/sell.

Novice traders tend to focus on the trade outcome and therefore do not think about the risk.

In contrast, professional traders focus on the risk and take the trade based on their proven trading system.

Refer to the following article in 2004 issue of Technical analysis of Stocks

and Commodities magazine to read about risk management

http://www.dreamtai.com/mainpages/moneymgt/mmgt.pdf

So, DreamTai uses a combination of methods to maximize your profits and minimise your risks.

![]()

|

|

Here are some instances of successful trades identified by DreamTai.

Intel

IBM

Microsoft

QQQQ

New feature:* DreamTai Blog at the following web page

|